Beautiful Work Tips About How To Buy Convertible Securities

Convertible bonds are debt securities issued by corporations that include an option for.

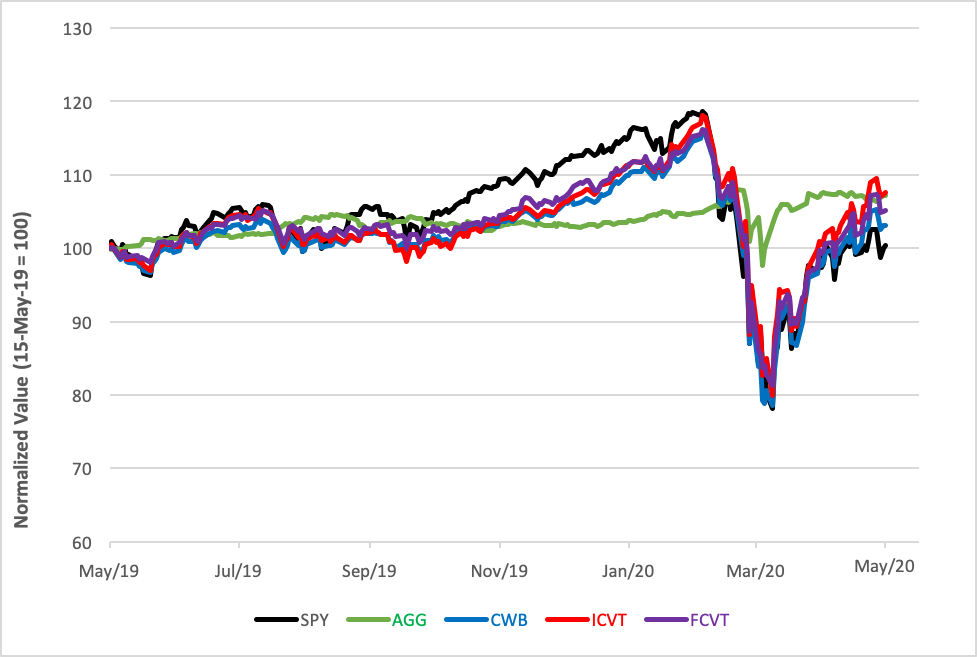

How to buy convertible securities. Key takeaways convertible securities have historically performed well during periods of rising rates, and lately they have performed as designed, falling far less than their. Lyft) today announced its intention to offer, subject to market conditions and other factors, $400 million aggregate principal amount. Convertible securities allow investors an opportunity to convert them easily without any hassles.

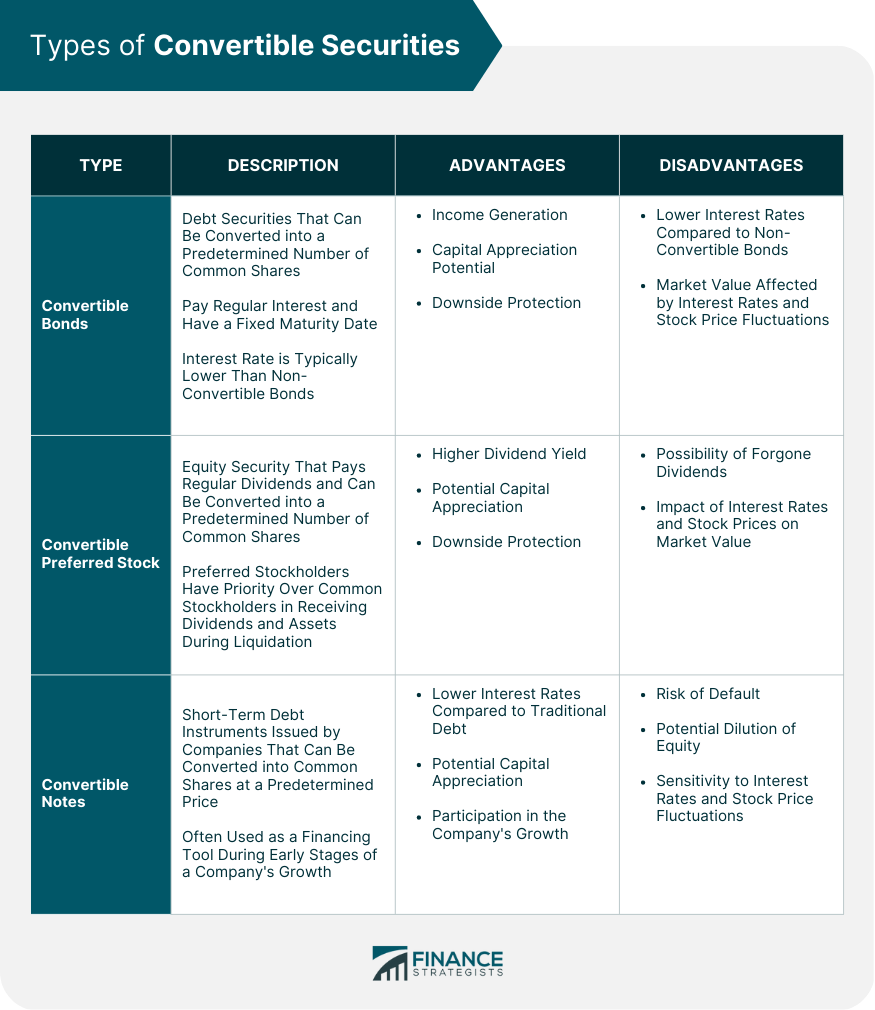

By david stein | updated june 14, 2023 what is a convertible bond? A convertible bond is a type of debt security that includes an option to exchange the bond for a predetermined number of shares in the. Key takeaways a convertible is a bond, preferred share, or another financial instrument that can be converted by the shareholder into common stock.

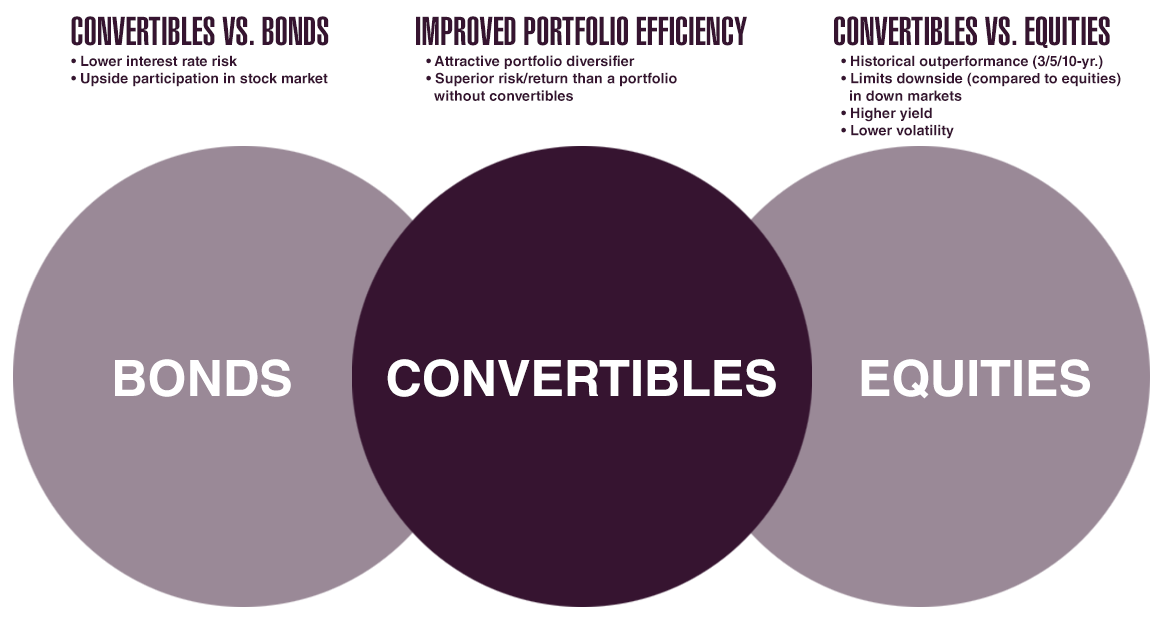

Convertible securities are hybrid financial instruments that offer investors the flexibility to convert their ownership stake into a different type of. Jul 2021 convertible securities, also called hybrid securities, are a special subset of securities. Getty a convertible bond is an investment vehicle that starts as a bond and then can turn into a stock.

A convertible security specifies the qualifying terms and price at. The most common forms of hybrid securities are convertible bonds and. Updated on december 3, 2022 written by rebecca lake convertible bonds are just one way to expand your investment portfolio beyond the traditional stocks you may already.

Convertible securities are securities or investment (preferred stocks or convertible bonds) which could be very easily converted into a different form like shares of an. A convertible security is an investment that can be changed from its initial form into another form. The most common types of convertible securities are convertible bonds and convertible preferred shares, which can be converted into common stock.

Changes and potential changes in monetary policy across the globe, along with increased volatility in currency and equity markets, have thrown a spotlight on. Learn more on this hybrid asset class. Convertible securities also offer companies the advantage of raising capital at a lower cost compared to traditional debt or equity offerings.

Nov 13, 2020 convertible bonds can be an attractive option for investors looking to supplement their income needs without sacrificing growth opportunities. A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain. These bonds are often framed by sellers as a way to reduce.