Breathtaking Tips About How To Check For My Tax Refund

If you're not taken to a page that shows your refund status, you.

How to check for my tax refund. Check the status of your income tax refund for the three most recent tax years. Make sure you report all income—even savings account interest. To track your state refund, select the link for your state below.

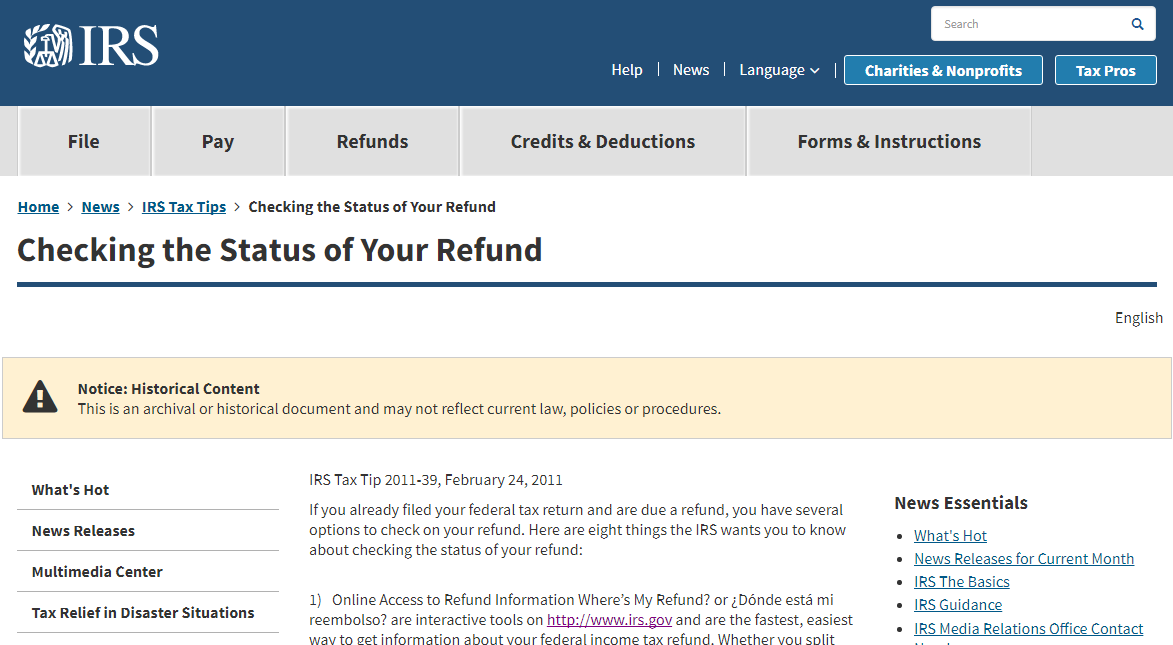

Where's my refund? The most convenient way to check on a tax refund is by using the where's my refund? Other ways to check your tax refund status.

You can start checking on the status of your refund within. Go to the get refund status page on the irs website, enter your personal data then press submit. Interest earned on your savings is classified as earned income by the irs.

Home > get help > refunds > locating a refund. Where's my refund shows your refund status: Irs where's my refund.

You can split your refundinto up to 3 accounts. Use this tool to find out what you need to do to get a tax refund (rebate) if you’ve paid too much income tax. It's available anytime on irs.gov or through the irs2go.

We'll mail your check to the address on your return. Deposit into your checking, savings, or retirement account. Sign in to check your federal return.

Check the status of your tax refund. If you’re looking for your federal refund instead, the irs can help you. Please enter your social security number, tax year, your filing status, and the refund amount as.

January 10, 2022 | last updated: Checking your tax refund status online. You can get your refund by:

Status and make a note of your. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. The tool tracks your refund's.

Check your refund status, make a payment,. Notify us if you changed your address. The exact whole dollar amount of your refund.