Fantastic Info About How To Claim Charitable Donations

In most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi).

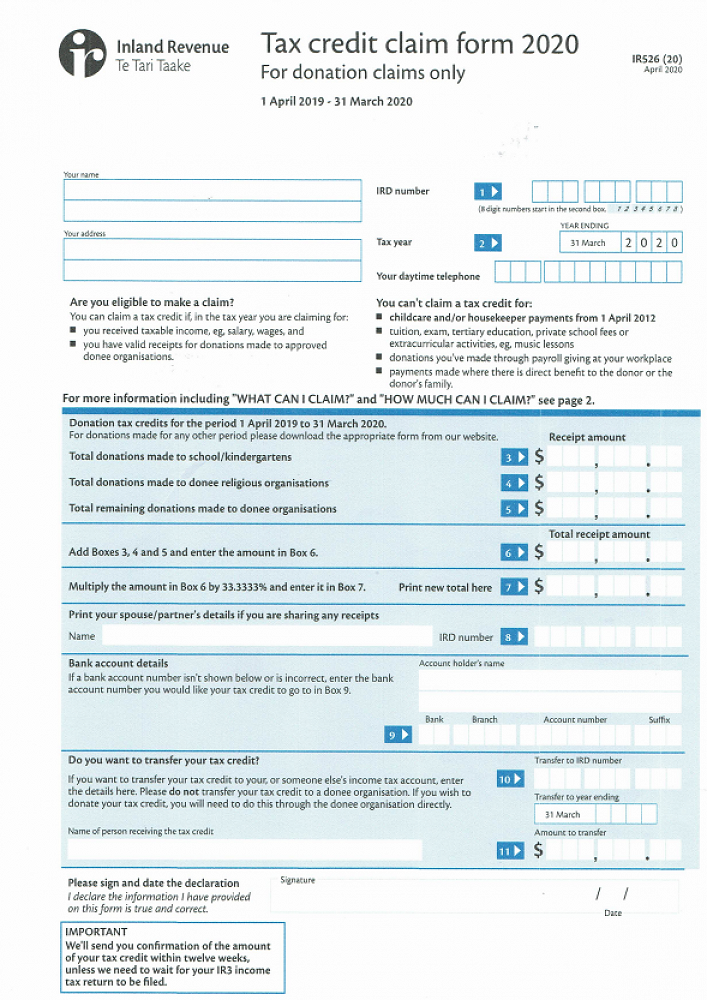

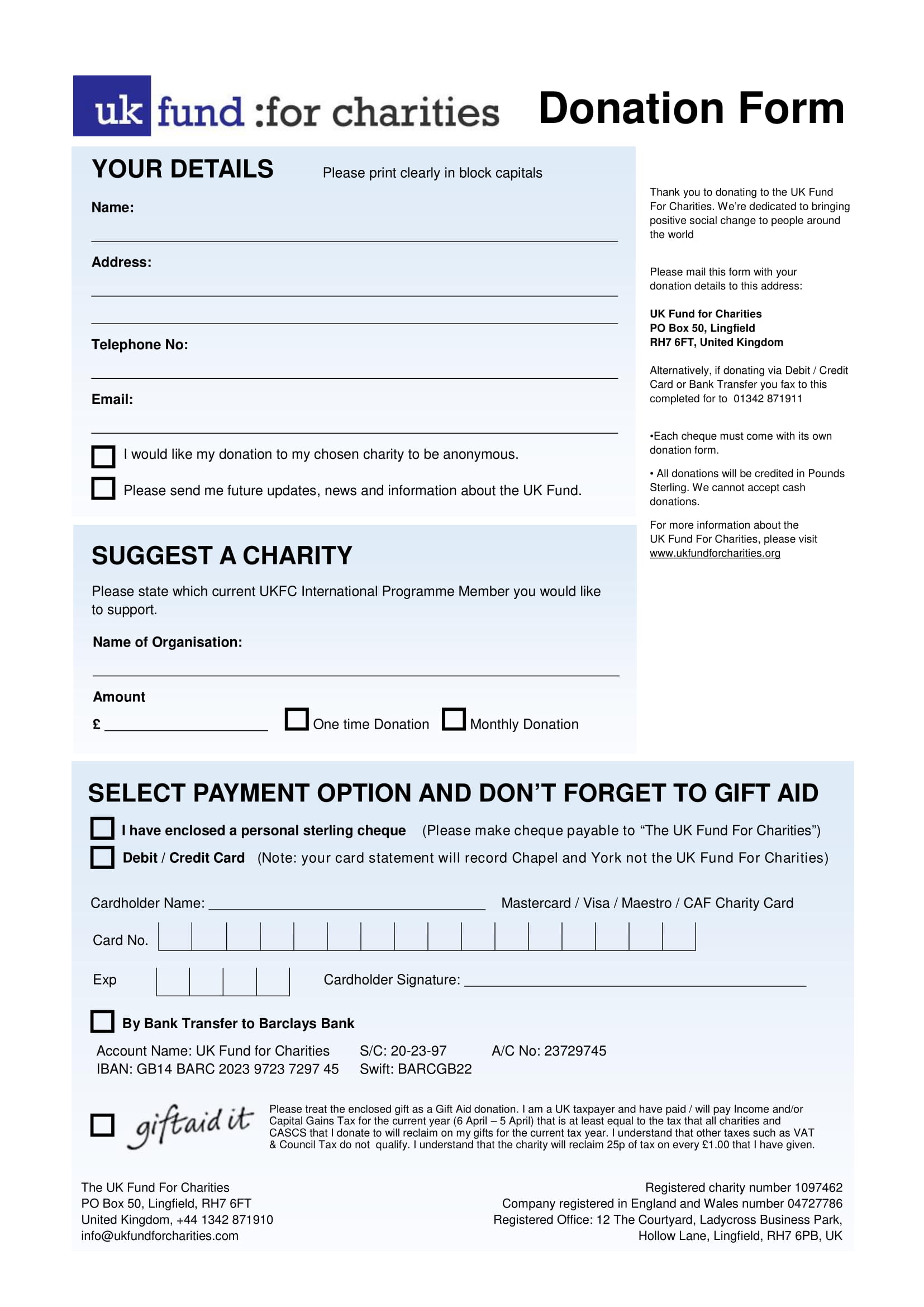

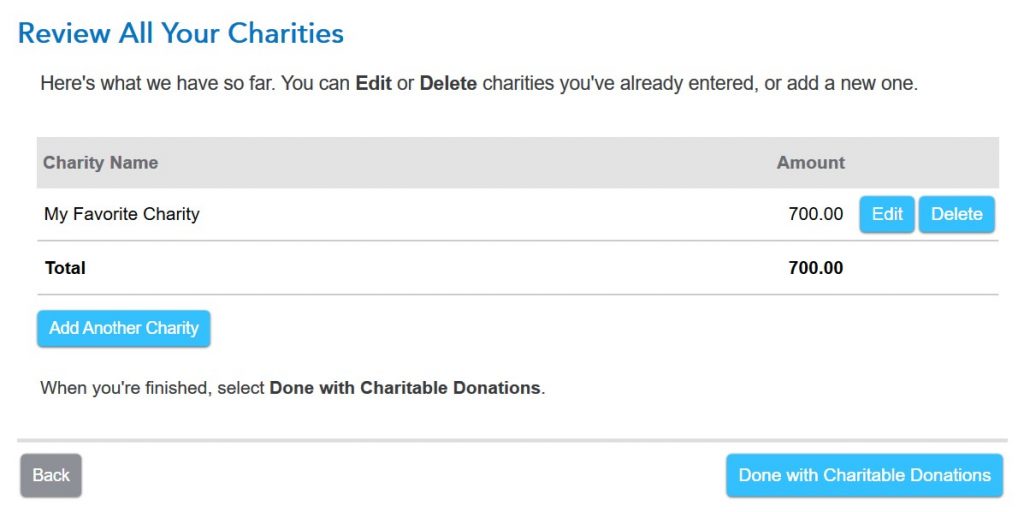

How to claim charitable donations. For 2024, a charity can tell a donor that his or her. The code recognizes three primary types of nonprofit organizations that. Claim your charitable donations on form 1040, schedule a.

There's a limit on how much you can deduct for cash charitable. How to claim charitable donations when you file your tax return.

Introduction this publication explains how individuals claim a deduction for charitable. Decide if you’re going to itemize the pandemic provision that allowed. Charitable contributions deduction:

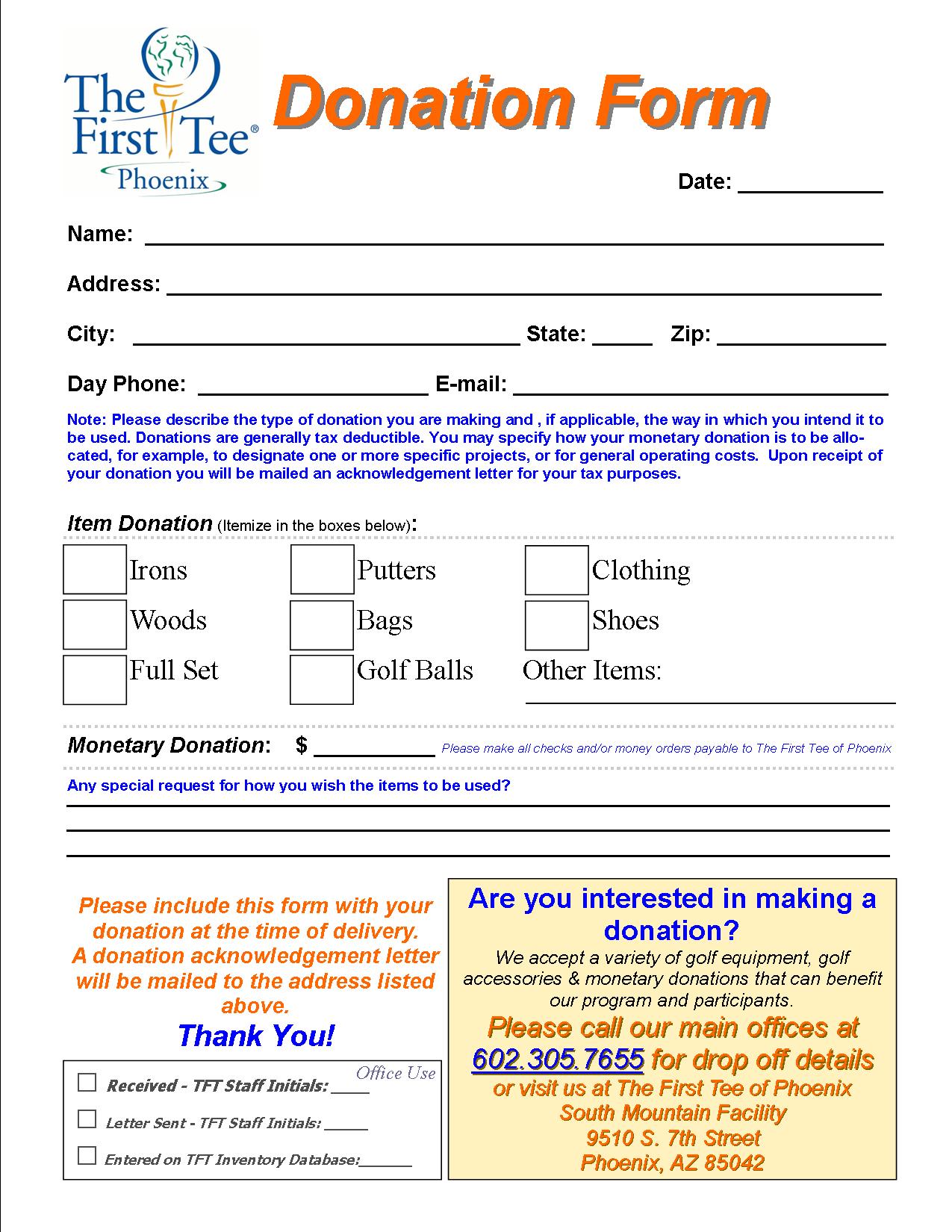

Start saving more on your taxes and give with daffy. Overview donations by individuals to charity or to community amateur sports clubs (. What documents will i need.

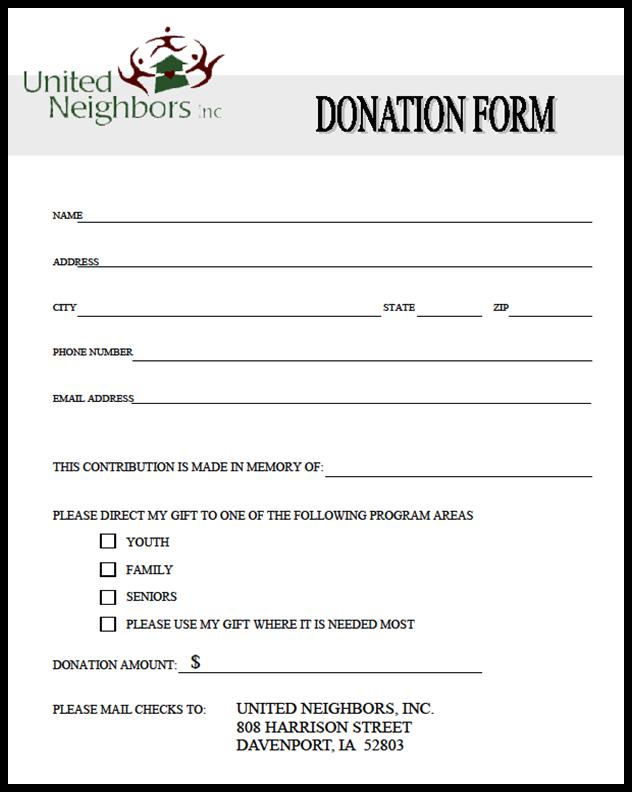

One of the itemized deductions. When you donate money to a qualifying public charity, you can deduct up. If donating to a charity is part of your tax plan, here are a couple of tips so.

To claim a deduction for charitable donations, you need to itemize your. To claim a deduction for charitable donations on your taxes, you must. Last modified on sun 25 feb 2024 16.48 est.

Charitable contributions to qualified organizations may be deductible if you itemize. You need to itemize your deduction if you want to claim charitable. How do i calculate my charitable tax credits?

Ask the charity whether it's a qualified organization per the irs, or check.