Fantastic Tips About How To Detect Payroll Fraud

Compare budgeted payroll to actual payroll.

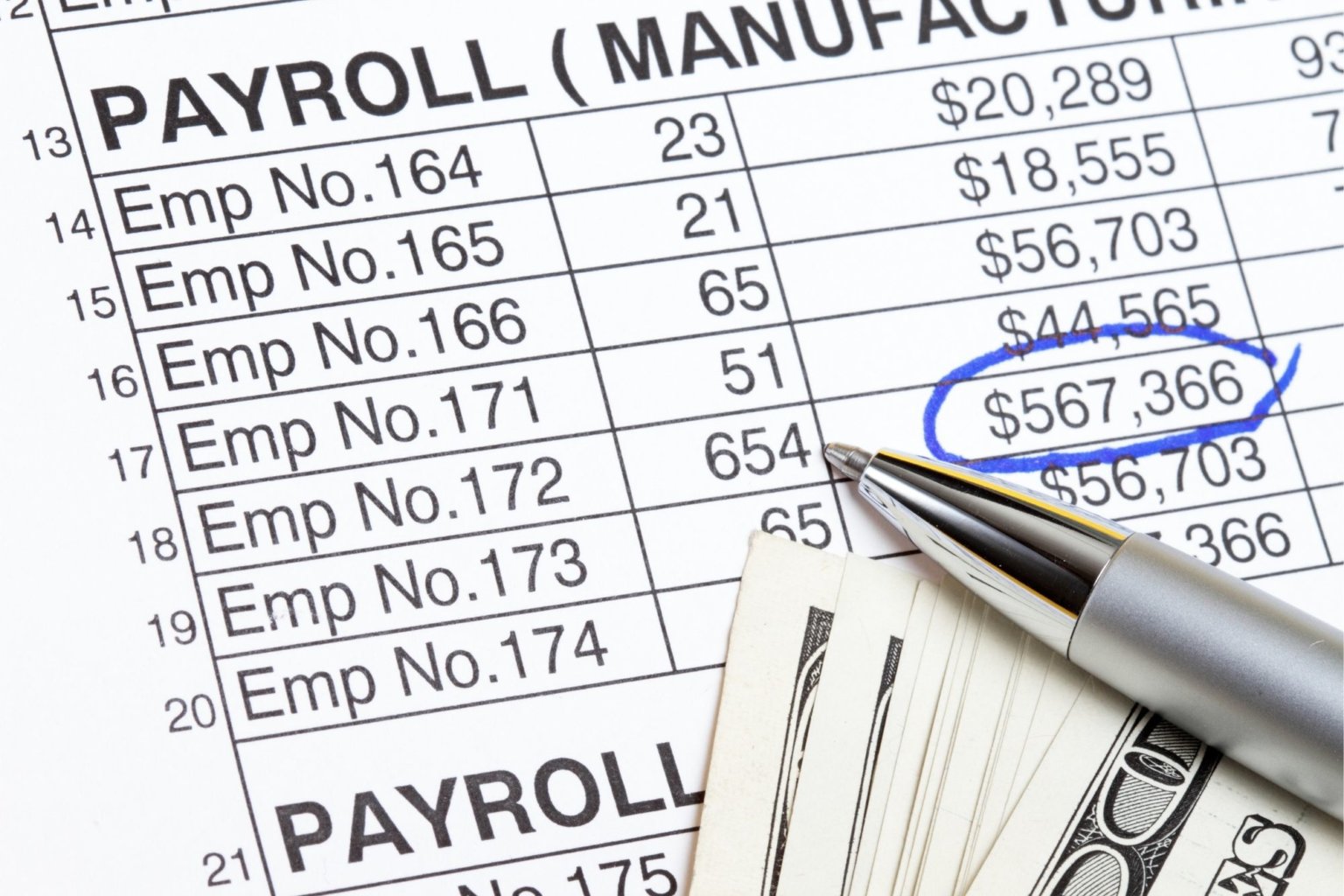

How to detect payroll fraud. Ghost employee fraud involves the creation of fictitious employees within the payroll system. It’s a crime that can be committed by both. Payroll fraud is any deceptive act that results in the unjustified disbursement of funds in the payroll process.

Symptoms of an employee living an overly expensive lifestyle for their earnings multiple employees that. Payroll fraud is when an individual illicitly alters a payroll system to manipulate employee compensation. The payroll department does not frequently necessitate working late or taking files home.

Common indicators of payroll fraud include: It’s critical to spend time on detecting and. Reconcile balance sheets and payroll accounts each quarter.

10 ways to detect and stop payroll fraud. Payroll fraud is one of the most prevalent and insidious kinds of company fraud, mostly because it can exist under the radar for a long period of time. By a colleague punching in for an absent employee or by an employee entering false information on the timesheet.

April 15, 2022 what is payroll fraud reading time 5 mins payroll fraud is damaging for any business, let alone a small company. Compare the check register with payroll records. However, payroll fraud is the toughest to detect because it’s often concealed.

Receiving a “preview” email for a payroll that you did not submit indication that a payroll has unexpectedly been transmitted or. Ghost employee fraud involves the creation of fictitious employees within the payroll system. Require managers or supervisors to.

Generally, this can happen in two ways: Some of the key signs that payroll fraud is taking place are as follows: Pay close attention to how employees act.

October 13th, 2022 | 7 min. Detect and prevent this common payroll fraud scheme. Payroll fraud is theft from a business that occurs via its payroll processing system, usually by an employee.

Criminals have developed many believable. Understanding payroll fraud. It is the theft of funds from.

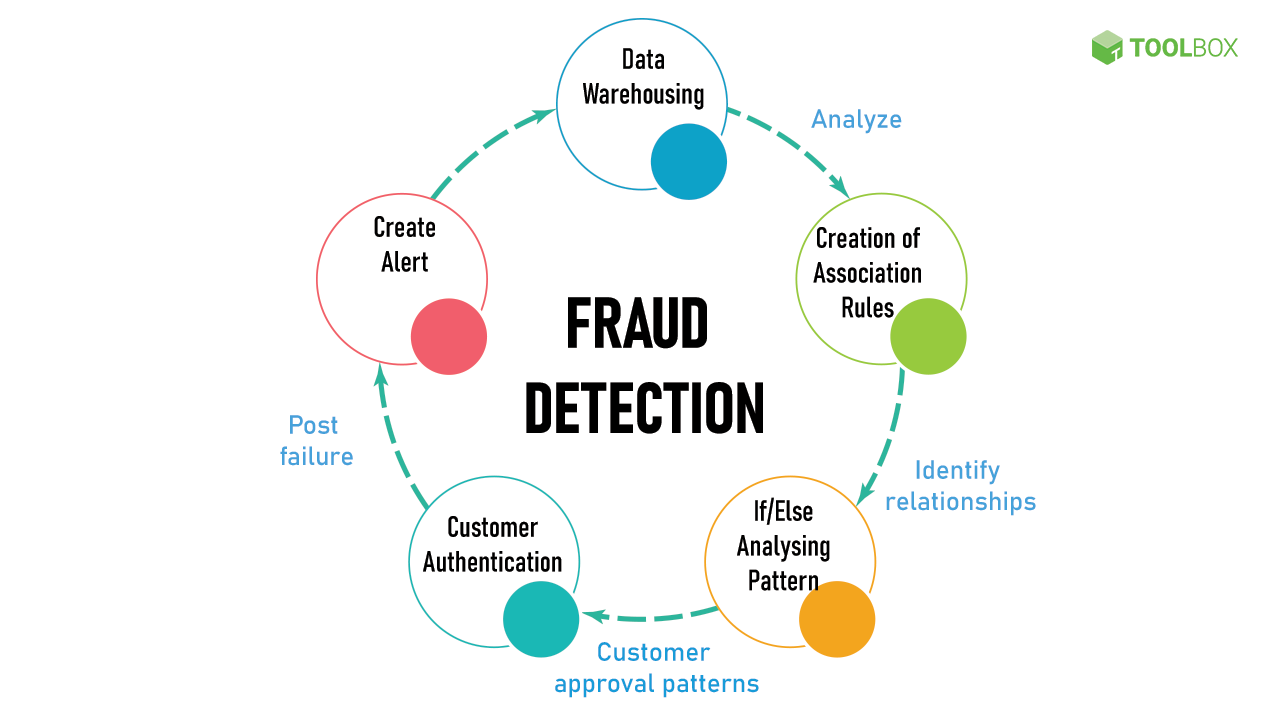

To prevent and detect payroll fraud: To effectively detect and prevent payroll fraud, it is essential to understand the various forms it can take: Learn how to effectively perform the appropriate measures to detect, deter, and prevent payroll fraud.fbi statistics show that employers lose more than $8 million a year to reported instances of payroll fraud.